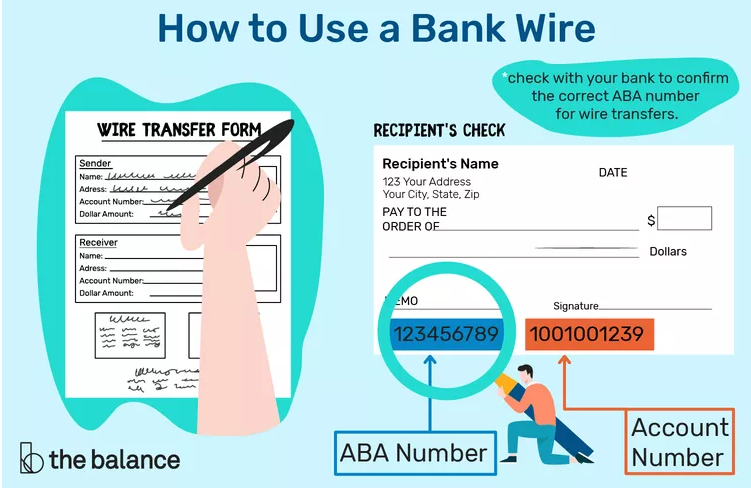

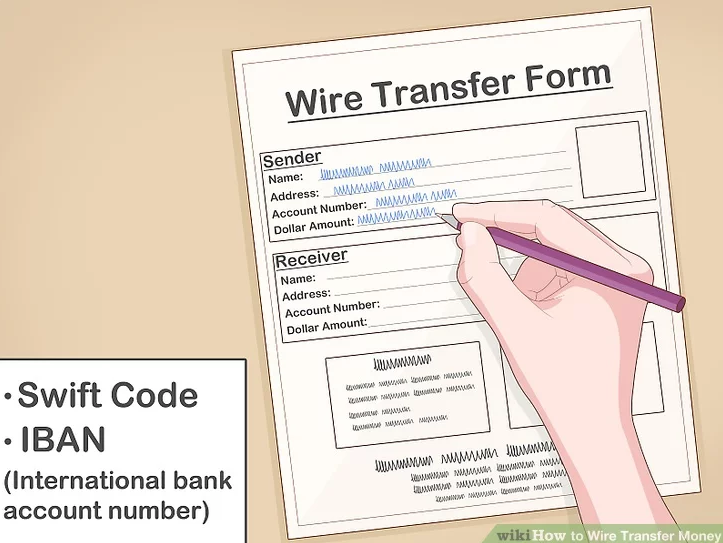

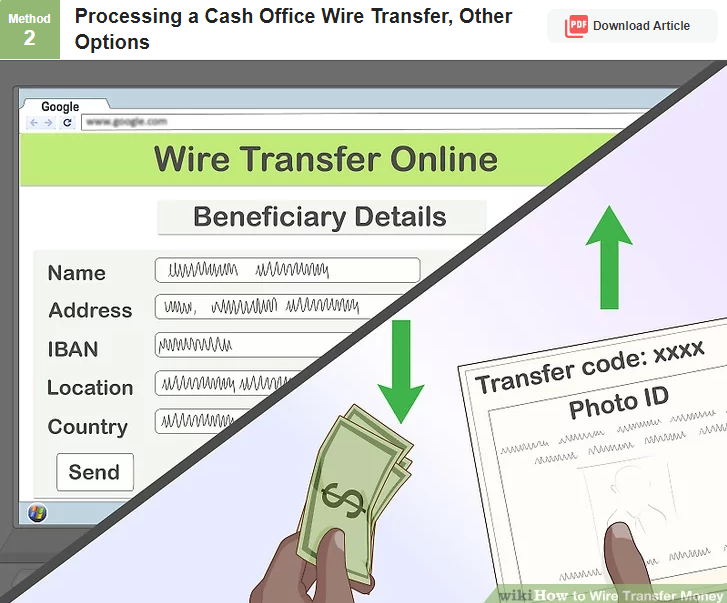

Wire transfers are a secure way to send money electronically, making them a popular choice for various payments. Follow these steps to complete your wire transfer correctly:

© FatFreeBody.com2024

Discount Applied Successfully!

Your savings have been added to the cart.